You can consider full-service brokers if you are not doing business or sometimes investment, more than 3-4 transactions per month.

If you are a cost-conscious regular trader, go with a discount broker like Zerodha.

Full-service brokers charge a percentage (0.5% to 0.1%) of the transaction value as brokerage. The brokerage amount can only be a few hundred rupees if your investment is 10,000-15,000. But if your investment is more than 1 lakh, the total brokerage amount will be huge.

You buy shares worth Rs. 1 lakh every month, that means Rs. 12 lakhs in a year, then you can pay 0.5% brokerage that comes out Rs. 6000 plus tax.

There is a benefit with full-service brokers – they have an internal research team that offers research reports, share trading tips, training for trading, a dedicated manager to address your queries and even stock recommendations. How To Open A Brokerage Account.

You can learn from them, but I would not advise you to follow them blindly because the recommendations are not complete evidence.

Read Aslo- Best Discount Brokers in India- Stock Trading Brokers 2021

Best Full Service Broker in India

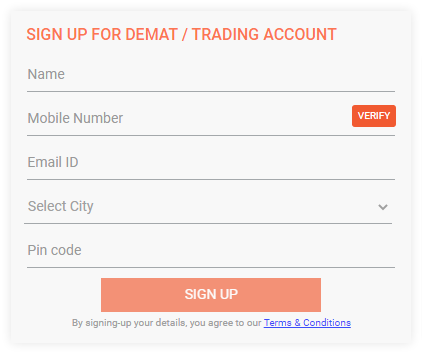

#1. IIFL Securities Full Service Broker

IIFL Securities is an investor who needs guidance and research support while making good investment decisions. You will get good customer support from the IIFL team. In fact, more than 40 million customers trade with IIFL Securities Limited.

You will need to pay brokerage on a percentage basis. The 3 different brokerage plans available include Investor Plan, Super Trader Scheme, and Premium Plan.

IIFL Account Opening Charges–

- Account opening charges – 250 (limited time offer FREE)

- First-year annual maintenance charges – Rs 0

- Annual maintenance charges second year onwards – Rs 250 (less than other full-service brokers)

IIFL Brokerage Charges–

| Plan Name | Investor Plan | Super Trader Plan | Premium Plan |

|---|---|---|---|

| Equity Delivery | 0.25% | 0.10% | 0.50% |

| Intraday | 0.025% | 0.01% | 0.05% |

| Options (per lot) | Rs 25 | Rs 10 | Rs 50 |

| Commodity / Currency Trading | 0.025% | 0.015% | 0.05% |

#2. Sharekhan Stock Broker Review

Sharekhan two decades of industry presence, with 2 million customers per day dealing with 15 million trades.

For merchants, Sharekhan filters your search and investment patterns Finder and warning equipment and identifies potential shares. Their value-added services portfolio management, including against the loan stocks and mutual funds.

Account opening and AMC Charges–

- Trading & Demat account opening charges- Rs. 0

- Trading account annual maintenance charges- Rs. 0

- Demat account annual maintenance charges- Up to Rs. 500 depending on scheme.

Brokerage fees charged by Sharekhan–

| Trading Type | Brokerage Charges |

|---|---|

| Equity Delivery | 0.50% (minimum 10 paise per share) |

| Equity Intraday (on both legs) | 0.10% (minimum 5 paise per share) |

| Equity Futures (1st leg) Equity Futures (2nd leg) | 0.10% 0.02% |

| Equity Options (on both legs) | 2.5% (minimum Rs. 100 per lot) |

| Currency Futures (1st leg) Currency Futures (2nd leg) | 0.10% (minimum 0.01 paise) Nil |

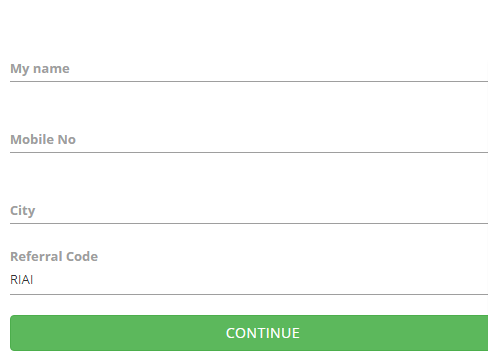

3. Angel Broking Review

Angel Broking is a 30-year full-service stockbroker with a flat commission of Rs. 20 per trade. Flat commission rates to save huge money if you can trade high volumes.

However, their value-added services stocks consultants, investments in bonds (corporate, tax-free, NCD, and government bonds), and are limited to the loan against shares.

Account opening and AMC Charges–

- Trading account opening charges-Rs. 0

- Demat Account-Rs. 0

- Annual maintenance charges-Up to Rs. 500 depending on scheme.

Brokerage fees charged by Sharekhan–

| Trading Type | Brokerage Charges |

|---|---|

| Equity Delivery | 0.50% (minimum 10 paise per share) |

| Equity Intraday (on both legs) | 0.10% (minimum 5 paise per share) |

| Equity Futures (1st leg) Equity Futures (2nd leg) | 0.10% 0.02% |

| Equity Options (on both legs) | 2.5% (minimum Rs. 100 per lot) |

| Currency Futures (1st leg) Currency Futures (2nd leg) | 0.10% (minimum 0.01 paise) Nil |

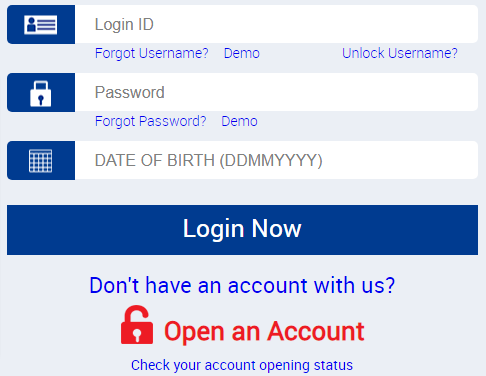

4. The HDFC Securities Review

HDFC Securities is a full-service stockbroking organization of HDFC Bank. HDFC Securities provides account for a 3-in -1, 2-in-1 and 1-in-1 trader and investor.

Value-added services research consultant, loan products (including auto, home, personal, and education), bonds, gold, ETFs, insurance, and NPS investment. HDFC Securities even if you provide the facility to invest in United States stocks

HDFC Securities account opening and AMC charges–

- Trading & Demat Account Opening charges-Rs. 0

- Annual Maintenance charges-Rs. 750

HDFC Securities brokerage charges–

| Segment | Brokerage Charges |

|---|---|

| Equity Delivery Trades | 0.50% (for both buy and sell orders) OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Intraday Trades | 0.05% (for both buy and sell orders) OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Futures | 0.025% OR a minimum of Rs. 25, OR Maximum of 2.5% on transaction value (both buy and sell) |

| Equity Options | Higher of 1% of the premium amount or Rs.100 per lot (Both Buy & Sell) |

| Currency Futures | The brokerage of Rs. 12 per contract on each side |

| Currency Options | The brokerage of Rs. 10 per contract on each side |

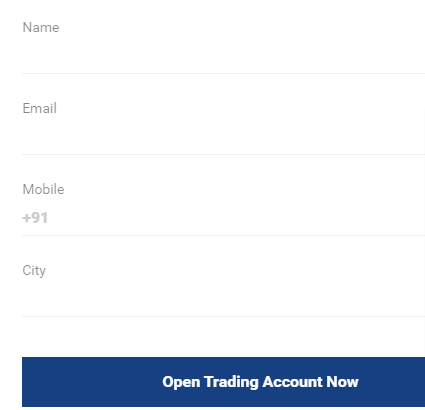

5. Edelweiss Stock Broker

Edelweiss Broking more than two decades of industry presence, with 12 million customers and Rs. 59,400 million of client assets under management.

You should go with Edelweiss Broking if you portfolio investment services needs dictate. They smallcase, directed offering portfolios and portfolio organizer services.

Other services mutual funds, ETFs, gold, and insurance products, including investment.

Annual Charges collected by Edelweiss Broking–

- Account Opening-Rs. 0

- AMC Charge- First Year – Free Second Year onwards – Rs. 500

Brokerage fees charged by Edelweiss Broking–

| Particulars | Edelweiss Lite | Edelweiss Elite |

|---|---|---|

| Equity Delivery | Rs. 10 per executed order | 0.30% |

| Equity Intraday | Rs. 10 per executed order | 0.30% |

| Equity Futures | Rs. 10 per executed order | 0.30% |

| Equity Options | Rs. 10 per executed order | Rs. 75 per lot |