Forex Brokers exchange is subject to active regulations in India and oversight of the Securities and Exchange Board of India (SEBI), which is an independent body tasked to ensure the smooth functioning of the country’s stock market and Forex Brokers. Commodity trading is also further regulated by the Market Commission, which is the regulatory structure for managing non-exchange traded financial instruments. The Reserve Bank of India is responsible for managing the Indian rupee but is not involved in the oversight of the foreign exchange broker.

India has changed rapidly since the liberalization of the 1990s. India’s economic performance has been strong following the regulations and the relaxation of the country’s opening to foreign ownership and investment.

Read Aslo- Best Discount Brokers in India- Stock Trading Brokers 2021

Best Forex Brokers in India

#1. Olymp Trade Forex Broker

Olymp business is a member of the international financial commission and belongs to the website and also by Saledo Global LLC.

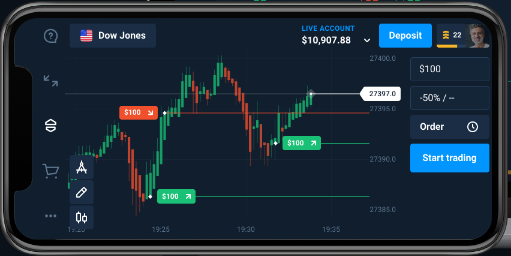

You can trade commodities, stocks, indices, ETFs, currencies, OTC, and Olymp trading platforms using the crypto property. Available leverage is up to 500 times.

Olymp Trade also offers innovative “Fixed Time Trading” (FTT) where you profit by forecasting currency exchange rates.

In fixed-time trading, you make forecasts as to whether the price of an asset will rise or fall over a certain period of time. If your forecast is correct, then you get a profit of up to 90% of the trade amount.

You have the flexibility to choose the trade time and set the trade amount as per your trading convenience.

#2. XM Global – Best Forex Broker

XM Global Trading Point is the subject of a sister concern of holdings and is regulated by SEBI in India and the International Financial Services Commission.

Well, almost 200 countries that belong to XM with 25 million merchants around the world.

Yes, it is the right business tools, such as currency pairs, stocks, commodities, metals, indices, and even energy.

XM with the trading platform, you can trade in different platforms, such as MetaTrader 4 and 5, which runs on the Web in various operating systems.

However, if you can start with asks for a deposit of $ 5 to take advantage of a 1:89 ratio that a micro account. You also get a demo account with a $ 10,000 virtual balance.

#3. OctaFX Forex Broker

You can trade 28 currency pairs, metals, CFDs, indices, and cryptos on OctaFX. The company is registered and regulated by the law of St. Vincent and the Grenadines.

The OctaFX account can be opened online with a minimum deposit of $ 20. Deposits can be made using Neteller, Skrill, local banks, Bitcoin, UPI and Paytm. You can also deposit / refund via MasterCard.

You benefit from a practice demo account, deposit, and withdrawal commission on OctaFX, and fast trade execution for nil.

#4. iForex – Top Forex Broker

iForex is not so popular, but it is not useful to review both merchants and financial institutions.

Of course, it is regulated and the regulator under British Virginia Islands Financial Services registered with the Commission that the currency pairs, crypto, indices, commodities, ETFs, and stocks provide tools like a business.

This web and mobile based platform also comes with over 800 devices for doing business. It functions in a one click business deal to gain good profit. Yes, beginners need not worry; It is available to apply strategies, markets, and charts while you trade.

The initial deposit is $ 100; Payment options available are Skrill, Neteller, MasterCard, Visa, and Telegraphic Transfer.

It has many customer support languages available, and it includes many of our Indian languages.

#5. FXTM Forex Broker

FXTM is controlled under the FSCA of reserves Ltd. is a brand of the Cyprus Securities and Exchange Commission (Cyprus), South Africa, and Conduct Authority of the financial sector (UK).

You can trade currency pairs, CFDs, stocks, cryptocurrencies, precious metals, and commodities.

You can trade more MetaTrader (MT4) and MT5 trading platforms to rapidly and safely from the web, desktop and mobile devices.

FXTM does not have its own trading platform but providing business tools in combination with MT platforms. Tools – FXTM pivot strategy and your trading strategies for trading signals tool support.

Allows Visa, MasterCard, Maestro, Skrill, Neteller, Webmoney VLoad, bank transfers – plus a host of payment methods like FXTM. FXTM also supports payment and crypto-purse Bitcoin.

Read Also- Best Online Stock Brokers for beginner

FAQ-

Ans- Forex trading is very popular among Indians especially in big cities like New Delhi, Hyderabad, Tamil Nadu, or Chennai.

According to the latest research study, 60% of ex pats from India like to invest in forex trading. The past During the recent years, several attempts have been made by the Government of India and the Reserve Bank of India to regulate the currency trading market. Especially in situations with weak Indian rupee currency and shortage of dollar.

Ans-

1. Good reputation among forex traders around the world

2. Allows you to trade micro-lots

3. Affordable minimum deposit (anywhere between $5 and $200 is fine)

4. Allows you to use local deposit methods

5. Oversight by a strong financial regulator (ASIC, FCA, CySEC, etc.)

6. MT4/MT5 is necessary only in case you plan to use Expert Advisor automated trading

7. Segregated bank account in a safe top tier world bank

8. Your deposits are insured → in case the broker goes bankrupt your money is safe

Insurance against negative balance

Ans- The truth is, forex is only half legal in India.

As a result of the government regulatory attempts, currently, RBI (Reserve Bank of India) allows you to legally trade with forex companies located in India only the currency pairs that include Indian rupees and that is USD/INR, EUR/INR, GBP/INR, JPY/INR. And what is the worst, those are not real forex companies, in fact, these are in fact stock exchange brokerages!