In the years 2022, discount brokers have changed the stockbroker scenario for the better. Discount brokers amount of business that you have a certain brokerage charge per trade regardless of help to save decent money in charge of their brokerage.

If you find best discount brokers in India, So in this article help you chose best stock Brokers trading brokers for 2022.

After around a decade these brokers started getting noticed, discount brokers are becoming more and more popular in recent years. As a matter of fact, many of such discount brokers are well determined and are capable of beating large ‘traditional’ trading companies. In this post, we are going to discuss eight of such best discount brokers in India.

Here, we are based on key features including an assessment of discount brokers in India their brokerage fees, fees for account opening, maintenance fees, offer services, trading platforms, pros, cons, and more. By the end of this article, you will better understand the various discount brokers in India, so you can choose that which you think is best. let’s get started!

Best Discount Broker in India

#1. Zerodha Demat Account

The Zerodha more than 12 million customer base of the largest discount broker in India and is to be applied before deciding broker brokerage fees. Zerodha takes a fixed commission of Rs. 20 intraday towards zero commission on trade and distribution.

Advanced charts and equipped with tools Jheroda because of its trading platform is the first choice for most traders. You can integrate with other devices such as your Zerodha account Sensibull, Streak and small case.

The Zerodha Brokerage Fee

- Equity Delivery– Rs. 0

- Equity Intraday– Lower of Rs. 20 per executed order or 0.01%

- Equity Futures– Lower of Rs. 20 per executed order or 0.01%

- Equity Options– Rs. 20 per executed order

- Currency Futures & Options– Lower of Rs. 20 per executed order or 0.01%

- Commodity F&O– Lower of Rs. 20 per executed order or 0.01%

Zerodha Account Opening & Annual Charges

- Demat & trading account opening charges – Rs. 200

- Commodity account opening charges – Rs. 100

- Annual maintenance charges – Rs 300

Trading Platforms: Kite 3.0, Kite Mobile, Console, Pi, Sentinel, Coin

Pros–

- Per trade flat maximum brokerage 20 bucks

- Innovative and user-friendly trading platform

- Big Brand Value and Customer Support

Cons–

- Constant delays and down service during business hours

- The margin provided is lower than other brokerage companies

#2. 5Paisa

The 5Paisa takes just flat brokerage fee of Rs cheapest discount broker in India. 10 / business on Titanium and Platinum plans.

The 5Paisa traders are best for those who need access to a simple platform for business or high-volume trader who wants to save money on brokerage charges. 5paisa Mobile trading is the best mobile trading app for the application.

5Paisa Brokerage Fee

- Delivery Trading: Rs 20 per trade

- Intraday Trading: Rs 20 per trade

- Equity Futures: Rs 20 per trade

- Equity Options: Rs 20 per trade

- Currency Futures: Rs 20 per trade

- Currency Options: Rs 20 per trade

The 5Paisa Registration & Annual Charges

- Optimum Plan – No plan charges

- Platinum Plan – Rs. 499 per month

- Titanium Plan – Rs. 999 per month

Pros–

- Free delivery business

- At the apartment brokerage to trade Rs.10

- 100% paperless account investment

- Stocks, investing in mutual funds and insurance from the same account

- Lower maintenance fees

Cons–

- Any 3-in-1 Account

- Higher currency transaction fee

- A commodity trading facility

#3. Upstox Discount Broker

Upstox traders who have one to look for low brokerage, high margin and good trading platform best discount brokers in India.

You can trade with low brokerage charges of a high margin of Rs 20 business and 28X for more income. Stock delivery value is free for investment.

What I like most about Upstox, its high-tech and advanced trading platforms. Upstox recently hit 10 million users and become the second largest discount broker after Zerodha.

The Upstox Demat Account fee

- Delivery Charges: Rs 0

- Intraday Trading: Rs 20 per executed trade or 0.05% whichever lower

- Futures Trading Charges: Rs 20 or 0.05% (whichever is lower) per order

- Options Trading Charges: Rs 20 per trade

Upstox Account Opening & Charges

- Account opening – Free (limited time offer)

- Upstox AMC – Rs. 25 per month

Pros–

- Free delivery business,

- Fast paperless Demat and trading account opening,

- Margin against the stock is available,

- 3-in-1 account available partnership with (IndusInd Bank)

Cons–

- When went to cancel the (GTC) good today so good / Time (GTD) orders are available

- Not available on margin funding distribution trades

- Report by customers of small technical problems on application

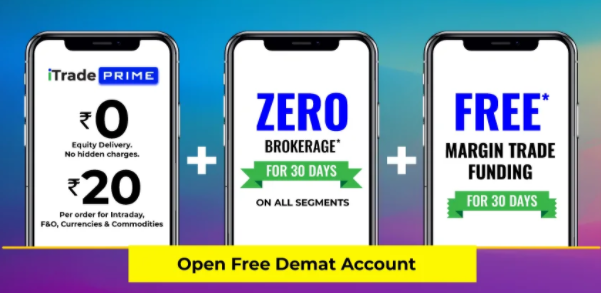

#4. Angel Broking

Has worked as a full-service broker of Angel Broking and offers one percent brokerage charges to its clients for over two decades. However, they recently changed their business model (November 2019) from percent brokerage to compete for a flat rate with fast-growing discount brokers like Zerodha, 5Paisa, Upstox, etc.

Angel Broking now offers a flat rate commission plan, named “Angel iTrade head. Here, delivery trading is free. And all other areas that one day, F & O, currencies and commodities, they charge a fixed rate per ₹ 20. The same simple rate is applicable in exchanges and segments.

Angel Broking Account Fee

- Delivery charges: Rs 0

- Intraday Trading: Flat ₹20 Per Trade

- Equity F&O: Flat ₹20 Per Trade

- Currency F&O: Flat ₹20 Per Trade

- Commodity F&O: Flat ₹20 Per Trade

Account Opening Charges with Angel Broking:

- Account opening charge: Rs 0 (Currently Waived)

- Annual Maintenance Charge: Rs 450 (Second year onwards)

Pros–

- The cheap full-service broker

- Process fast account opening

- Flat Brokerage,

- 48x to leverage,

- Expert research reports and market consultant

Cons–

- No 3-in-1 account

- Call & Trade are charged extra

#5. Samco Review

Samko Discount Broker lower brokerage fees and high risk, margin products, and is known for the free trading products.

Is a unique feature of SAMCO that you can take a loan against shares and other financial products.

SAMCO BSE, is a member of the NSE, MCX, MCX-SX, NCDEX and allows you to trade.

The SAMCO Brokerage Fee:

- Equity Delivery- Lower of 0.2% or Rs. 20 per order

- Equity Intraday- Lower of 0.2% or Rs. 20 per order

- Equity Futures– Lower of 0.2% or Rs. 20 per order

Samco Registration & Annual Charges

- Trading account opening charges – 0

- Demat account opening charges – 0

- Trading account AMC – Rs. 400

- Demat account AMC – 0

Pros–

- Free trade and open a demat account,

- Excellent margin products available to dealers,

- The flat maximum rate of Rs brokerage scheme for 20 business

- Based instant paperless account opening.

Cons–

- Not available online IPO, FPO application

- Mutual fund investment is not available

- No branches to offer local offline support

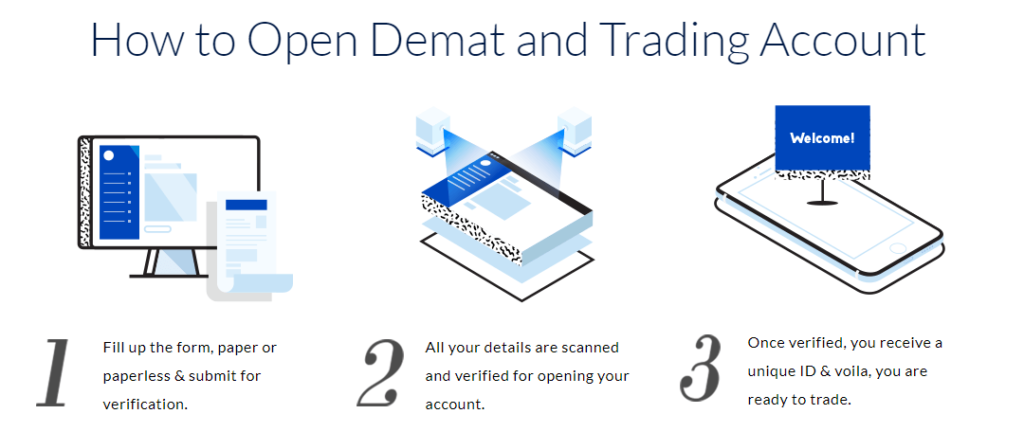

What exactly is a discount broker?

Discount brokers offer low brokerage, providing high-speed, and stocks, commodities, and a fast platform for trading in currency derivatives. Brokerage charges while trading way with these discount brokers is lower than traditional brokers in India like HDFC Securities, ICICI Direct, SBI caps, etc.

In addition, the business model of a discount broker is quite simple. They offer a flat brokerage rate for every trade their client makes, and this does not depend on the size of the trades. This rate is typically between 10 rupees or 20 per trade.

On the other hand, full-service brokers charge a fraction of fee on the transaction volume. This commission can be as high as 0.3-0.7% of the transaction volume. Therefore, as the volume of the transaction increases, you have to pay more and more brokerage.