Initially, the stock market can fluctuate, but the best broker can help you figure out which shares to buy or when to sell. This article will help you find the best broker in 2022.

We believe that we all are living through a particularly volatile time we deal with this global crisis and has seen unprecedented changes in financial markets, affecting all investors. Our goal is to always help people to have been, when, and most informed decisions about where to invest. Given the recent market volatility and changes in the online brokerage industry, we are committed more than ever to providing our readers with unbiased and expert reviews of top investment platforms for more investor starters.

What is a stock brokers?

You can think of Online stock brokers as the conduit for the stock markets. In exchange for a commission on each trade, they tend to stock exchanges and market makers, which is actually someone who wants to sell and send their orders to the big task of your purchase order matching with contrast. Know about Best Forex Brokers in India.

You and I knock down the door to the stock markets and trade without a broker can not do yourself. In fact, the Online stock markets we in movies and on TV to find them by their portrayal does not really exist today. Believe it or not, most business actually takes place between computers located in dimly lit server rooms in New Jersey, just a few miles from New York City’s Financial District.

5 best Online Stock Brokers for beginner

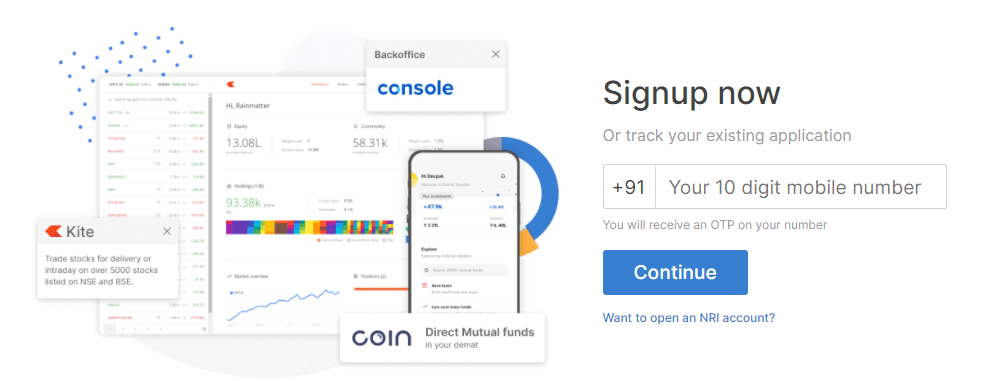

#1. Zerodha No.1 Broker

Zerodha has been founded by Nitin Kamath in 2010, provided that India bound free equity and the Commission for the biggest discounts and a day and all the other traders in mutual fund investments. It is more than +3 million compared to more than% of daily retail trade 15 clients and contribute to the Indian stock market. The mobile application ‘Kites’ had downloaded more than one million on the Play Store. Zerodha is the best online stock brokerage in this market.

Zerodha is also very welcoming in terms of test driving the platform without making a commitment. If you poke around, you can open an account and make a deposit, and until you are comfortable putting money down to take advantage of all learning opportunities.

Zerodha Brokerage Fee

| Type | Brokerage |

|---|---|

| Equity Delivery | Rs. 0 |

| Equity Intraday | Lower of Rs. 20 per executed order or 0.01% |

| Equity Options | Rs. 20 per executed order |

| Currency Futures & Options | Lower of Rs. 20 per executed order or 0.01% |

Advantages & Disadvantages

| Advantages:- | Disadvantages:- |

|---|---|

| 0 present brokerage on delivery | slight problem in Zerodha kite app |

| Give the best investment option. | 0.2% complain about Zerodha |

| Fix brokerage of Rs 20/trade on intraday | |

| Best service provider and 24hrs customer support |

#2. HDFC Securities

HDFC Securities is a bank-based full-service provider brokerage. It offers a full-service charge and the best offer is active with about a minimum of 7 lakh user subscribers. This is trustworthy as only 0.01% of customers complain about brokerage. You will also get HDFC Security mobile app, you can do trading with the help of the app sitting at home and ask for any problem through chat and you will get help well.

HDFC Securities Brokerage Fee

| Type | Brokerage |

|---|---|

| Equity Delivery | Rs. 0 |

| Equity Intraday | Lower of Rs. 25 per executed order or 0.01% |

| Equity Options | Rs. 25 per executed order |

| Currency Futures & Options | Lower of Rs. 25 per executed order or 0.01% |

Advantages & Disadvantages

| Advantages:- | Disadvantages:- |

|---|---|

| 0 present brokerage on delivery | 0.1% complain about HDFC Securities |

| 50000 people rated HDFC Securities Brokerage App 4.3 | |

| Fix brokerage of Rs 25/trade on intraday | |

| Best service provider and 24hrs customer support |

#3. Kotak Securities Full Service Stockbroker

With the support of Kotak Mahindra Bank, Kotak Securities is a full-service share broker having a presence in 393 cities with 1539 branches, franchisees.

Services include the offering of shares, derivatives, mutual funds, IPOs, and investing in ETFs. You can also portfolio management and business meet in research advisory services.

Kotak Securities Brokerage Fee

| Type | Brokerage |

|---|---|

| Equity Delivery | 0.49%, Min 4 paise per share |

| Equity Intraday | 0.049%or Rs. 21 per executed order, whichever is higher Min 3 paise per share |

| Equity Options | Rs. 20 per executed order |

| Currency Futures & Options | 0.049%Min 3 paise per share subject to a ceiling of 2.5% of the contract value |

Advantages & Disadvantages

| Advantages:- | Disadvantages:- |

|---|---|

| Zero brokerage for intraday trades across Cash, Futures & Options, Currency & Commodity | 0.2% complain about Kotak Securities |

| Equity & Commodity Delivery at just 0.25% of transaction value | Any request for activation received before 3:30 PM on a working day would be processed the same day. |

| Fix brokerage of Rs 25/trade on intraday | |

| Best service provider and 24hrs customer support |

#4. Upstox Discount Broker

By Upstox traders, who look for a low commission, high margins and good trading platform best discount brokers in India.

You can trade with Rs 20 business and brokerage charges a higher margin of 28X for more income. Stock distribution price is free for investment.

Upstox recently hit 1 million users and Zerodha later became the second-largest discount broker.

Upstox Demat Account fee

| Type | Brokerage |

|---|---|

| Equity Delivery | Rs. 0 |

| Equity Intraday | Lower of Rs. 20 per executed order or 0.01% |

| Equity Options | Rs. 20 per executed order |

| Currency Futures & Options | Lower of Rs. 20 per executed order or 0.01% |

Advantages & Disadvantages

| Advantages:- | Disadvantages:- |

|---|---|

| It is a low commission rate discount brokerage account. | 0.2% complain about Upstox app |

| Support at Upstox is fabulous! It’s quick, effortless, and efficient. | |

| Delivery trading for life. No hidden charges |

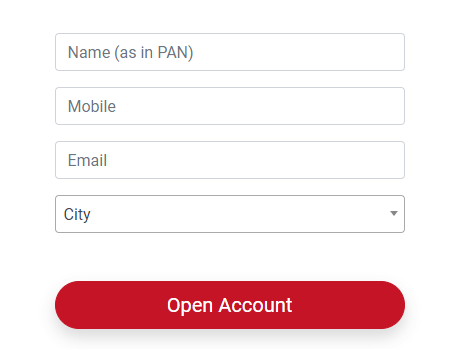

#5. Sharekhan Stock Broker

Sharekhan a pan in a full-service stockbroker 2+ million industry presence with customers and 541 million running two decades of India presence.

Value-added services, mutual funds, investment, and portfolio management services. New traders can benefit from courses of various stock trading ShareKhan education.

Sharekhan offers different optimized for a thesis advisor traders, investors, and mutual fund investments.

Sharekhan Stock Broker Account fee

| Type | Brokerage |

|---|---|

| Equity Delivery | 0.50% (minimum 10 paise per share) |

| Equity Intraday | 0.10% (minimum 5 paise per share) |

| Equity Options | 2.5% (minimum Rs. 100 per lot) |

| Currency Futures | 0.10% (minimum 0.01 paise) Nil |

Advantages & Disadvantages

| Advantages:- | Disadvantages:- |

|---|---|

| Monthly online sessions where you can meet other like-minded investors and traders and grow together | 0.3% complain about Upstox app |

| Best service brokerage for help 24hrs chat support. | |

| Zero treading opening charge |

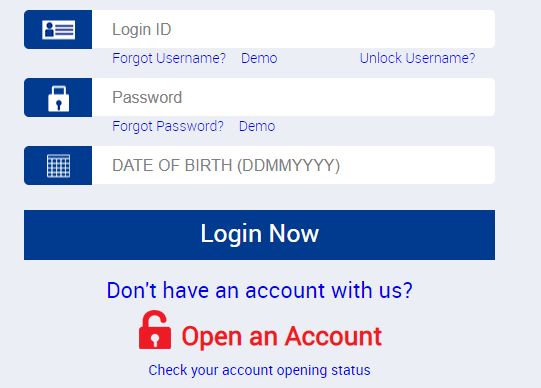

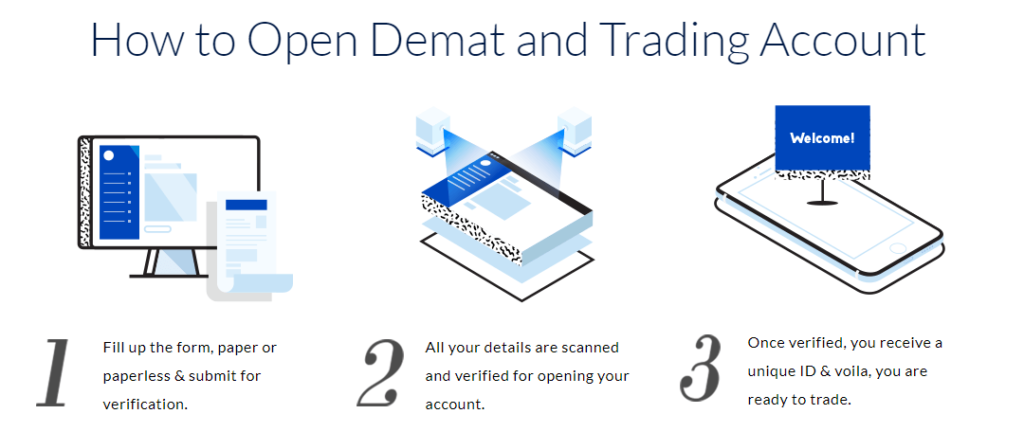

What You Need to Open a online stock Brokerage Account

The following details handy when you’re ready to start the process:

- Name

- Address

- Date of birth

- Social security number (or taxpayer identification number)

- Telephone number

- E-Mail Address

- Driver’s license, passport information, or other government-issued identification

- Employment status and occupation

- Annual income

- Net Worth

FAQ:-

The amount is more as an investor to get started you need where you have nothing to do with the investment in opening an account.

1. Mutual funds — mutual funds have minimum investments of around $1,000

2. Exchange-traded funds (ETFs) – ETFs have lower share prices, trading for $100 or less.

3. Stocks – The minimum amount to get started investing in stocks is typically the price of one share.

Withdrawing your money from a brokerage is relatively simple. It is usually invested in some property when you have money in a brokerage. Sometimes the cash is left on the side account but not invested. This excess cash can always be withdrawn at the same time as any one bank account withdrawal. The other money goes is that the investment can be withdrawn only by the liquefaction of the positions held. This means that the property is bought and sold like stocks, ETFs, and mutual funds. Once sold, you can withdraw that cash.

Yes it is possible, but for this you need a lot of knowledge and you will be doing it with very experience if you can invest and can extend your investment.

There are two main types of brokerage account:-

1. cash account is a brokerage account in which a customer is required to pay the full amount for securities purchased, and buying on margin is prohibited.

2. Margin account is a brokerage account in which the broker lends the customer cash to purchase stocks or other financial products.

Read Also :- How to Invest in Stocks A Beginner’s Guide

Read Also :- How to Invest in Index Funds Simple Investment