The global pharmaceutical industry tops $ 1.2 trillion in sales every year. That is a huge market, and it creates tremendous opportunities for the advancement of life quality with long-term investors for patients. And COVID -19 epidemic has attracted more attention to the development of pharmaceutical companies Corona drug and vaccine candidates. Along with these opportunities, however, come significant risks. See Bitcoin Wallet.

If you find best pharma stocks to invest, So this article helps you give top 5 best pharma stocks. Pharma sector is one of the most loved sectors in the Indian stock market, the Pharma stocks gave a return of 30% CARG between 2009 and 2016 that was the golden time for best pharma stocks.

Information of Pharma Sector

S & P BSE Healthcare Index 2009 to 2016 gives a beautiful CAGR of around 30% in 7 years That jumped almost six times in seven years in the last bull run. However, the story turned sour after the four years that in absolute terms the index lost almost a third of its value.

The 11-year CAGR of the index still stands at a respectable 14% and that came with a stomach-churning roller coaster ride. The pharmaceutical sector, the US Food and Drug Administration (USFDA), and stringent regulatory requirements delayed drug approvals, as did a complete poor performance due to many factors such as pricing pressures in the United States. . But, Indian pharma companies have always maintained a good standing in the global pharmaceutical industry.

They are leaders in continuous manufacture of generic drugs could be both domestically and globally. Drugs manufactured in India have access to a variety of advanced economies such as the US, UK, and EU. Besides, India also has a cost advantage, since drugs made more affordable and help reduce the increasing global economy and brought health budget.

The outbreak of the current epidemic has brought back the fascination of the pharma sector. The increase in demand for certain essential drugs in particular has given a much-needed boost to the field. Also due to the extended lockdown, along with other sectors, pharma companies are facing challenges in which factories are operating with low manpower capacity, producing essential and limited medicines. However, the pharma sector is one of the least affected by the COVID-19 status and strong demand for essential drugs will aid growth for companies.

Pharma companies could be attractive to investors in the long run, despite the volatility. Growing industry is becoming an important part of the size and health service life, if investors can earn good returns they invest at the right time. In addition, an emerging industry, innovation, scientific breakthroughs and technological development is going to bring in exponential growth for a number of pharmaceutical companies.

List of 5 Best Pharma Stocks to Buy In India

| Sr. | Company | Last Price | Market cap (Rs. Cr.) | CMP (Change%) | Latest P/E |

|---|---|---|---|---|---|

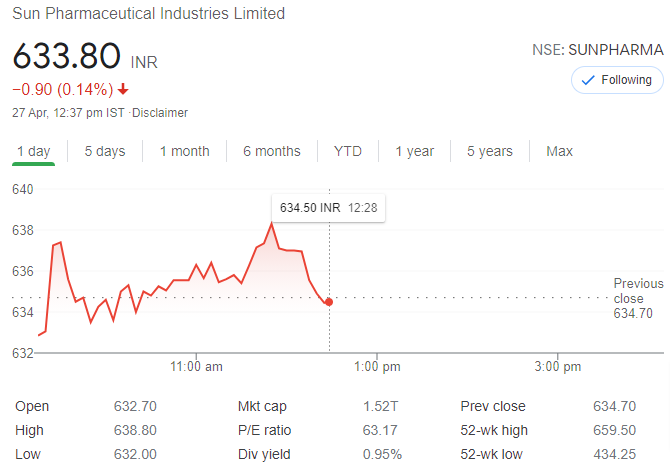

| 1 | Sun Pharmaceutical Industries | 634.60 INR | 1,52,250 | 638.00 | 63.19 |

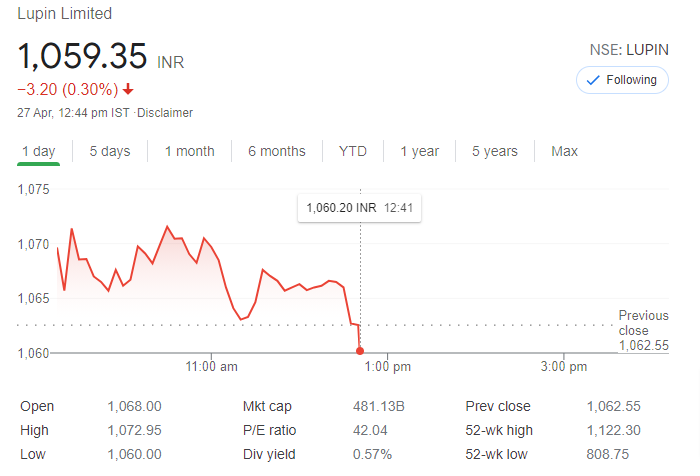

| 2 | Lupin Ltd. | 1,060.20 INR | 48,213 | 1066.90 (0.40%) | 42.08 |

| 3 | Dr. Reddy’s Laboratories | 5,037.65 INR | 84,298 | 5082.30(0.26%) | 38.75 |

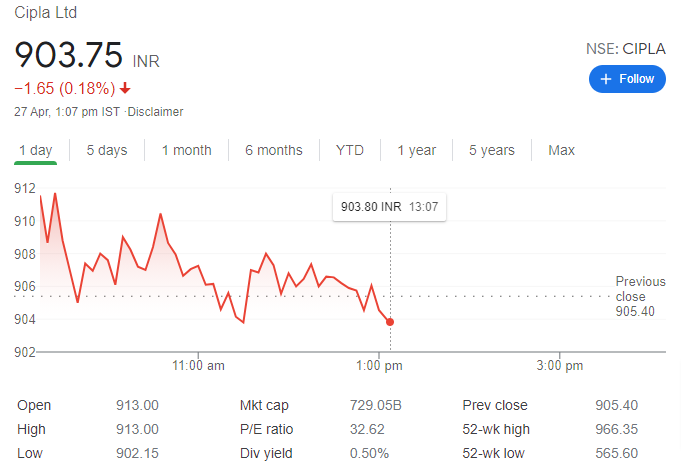

| 4 | Cipla | 903.75 INR | 72,614 | 907.30(0.77%) | 27.3 |

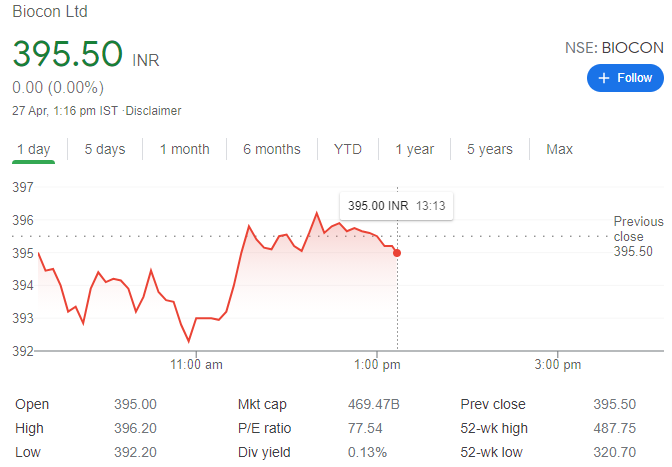

| 5 | Biocon Ltd. | 395.00 INR | 47,472 | 395.25(-0.09%) | 154.93 |

1. Sun Pharmaceutical Industries

The first rank is secured by Sun Pharmaceutical Industries Limited, a multinational Indian company based in Mumbai.

Its main market is India and the United States and currently, India’s largest pharmaceutical company is the largest Indian pharmaceutical company in the United States.

A leader in the Indian pharmaceutical sector, Sun Pharmaceutical Industries has a market capitalization of Rs.120422.62 crore – the reason why it is the best pharma shares to buy.

Following 52 weeks and shows the high proportion being over 312.00 and the highest being 564.75.

With a big reputation in a major customer base and pharmaceutical market, the company enjoys a good dividend to shareholders 0.80%

READ ALSO- Investing in Dividend Stocks

2. Lupin Ltd

In eighth position, there Lupine Limited, an Indian multinational company headquartered in Mumbai Pharma.

One reason why it is one of the best pharma stocks in India – it has managed to become one of the largest generic pharmaceutical companies with global revenues.

It bucks the market capitalization. 41790.85 crore, due to the fact that Lupine United States, Europe, and an excellent market presence in countries such as Japan, Australia, South Africa, the Philippines, Mexico, and Latin America.

52weeks good record of low and high ratio, where the lowest was recorded at 504.75, while the highest 1035.00. Its shareholders receive a dividend of 0.65%.

3. Dr. Reddy’s Laboratories

Dr. Reddy’s Laboratories is among the top Indian generic players in the US market with a focus on other important priority markets such as India, Russia, China. This focused approach improves profitability with existing non-core assets by the new leadership team. It is expected that the income scale-up will improve with the introduction in the US and faster execution of various drugs in an emerging market. It will continue to improve margins, coupled with a focus on cost control measures. In addition to this, it has been observed that the normalization of the possibility of US revenue price has bottomed out with erosion, and pick-up launch will reduce his dependence on just a few products in motion.

The company has been able to efficiently execute pre-American business which is reflected in its superior earnings performance in recent quarters. Future development is dependent on the approval and launch of gVescepa with less general price erosion in the core portfolio. Risk certainly includes, but is not limited to regulatory issues, delays in product launches in the US, and adverse foreign exchange fluctuations.

4. Cipla Ltd

With a strong presence in Cipla respiratory area is a major player in the domestic market. The company is building a US franchise with a focus to launch complex generics for steady growth. It has shifted its focus to India that trajectory to accelerate domestic demand.

The recent approval of Albuterol will ensure growth in the US and margin improvement in the medium term, given the decrease in respiratory products in the US due to COVID-19. Pharma companies do not have a large US portfolio, but with an increase in respiratory risk in the domestic market, approval of Albuterol inhaler should drive strong income in the coming years. Adverse regulatory actions at risk facilities (particularly from the USFDA), adverse factors affecting growth and profit for major markets such as South Africa, (NLEM) list of essential drugs that delay any new product approvals Along with the expansion will affect domestic revenue.

5. Biocon Ltd.

Established in 1978, the consistent performance that Biocon Limited has demonstrated over the years has successfully moved it to the fifth rank Best Pharma shares list.

Located in Bangalore, this Indian biopharmaceutical company produces generic APIs that are marketed in more than 120 countries.

These reasons are enough for convincing the investors in investing this stock, and therefore the net worth of this company stands at an estimated Rs. 50076.00 crores at present.

The dividend Biocon provides to its shareholders is 0.08%. The growth of this pharma-giant can be seen from its 52weeks low and high ratio analysis, where the low is 212.20, and the high is 446.95.