Best Banking Stocks in India. Investors can get an array of options for bank stocks to buy, and they must choose wisely.

Bank shares in India are considered to be one of the most profitable financial instruments that bring in high returns.

They are the backbone of the country’s stock market and attract the maximum amount of investment.

If you can find the Best Banking Stocks in India to invest your money this is the right platform to help you find the Best Banking Stocks in India.

Importance of the Banking sector in India

Whatever the basis of the banking sector economy goes through its own stages of ups and downs. When everything in the economy is rosy, lending and lending boom and this in turn leads to healthy growth in banks. And when it gets harder, defaults increase and this leads to an increase in bad assets (bad debt). Last year Prime Minister Narendra Modi set a USD 5Tn economy target for India Inc which is being achieved within the next five years.

However, considering the various challenges due to lockdowns and economic slowdown, loan passes from banks should grow by 12% every year in order to have a USD 5 trillion economy figure at least for the purpose by 2024 and these banking Players have always remained flexible, growing continuously through more than one economic cycle in order to capitalize on every opportunity.

Top 5 Bank Stocks to Buy in India- To Invest in Banking Sector

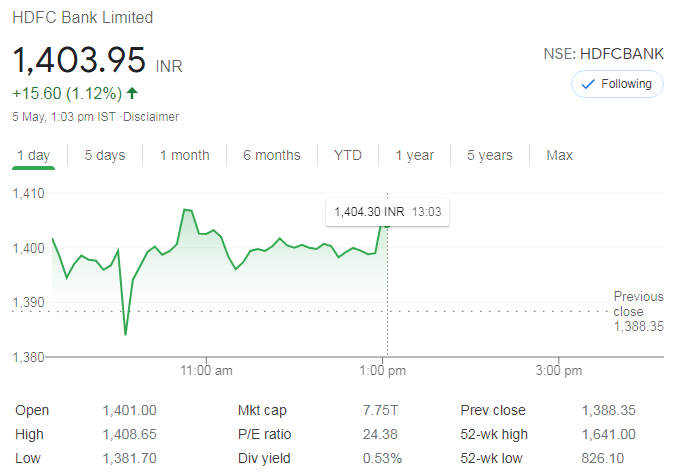

1. HDFC Bank Ltd.

HDFC Bank Limited boasts the largest market capitalization and is one of the best bank Small-Cap stocks to buy in 2021.

The stock has already recovered from its 52-week low and so has gained momentum. The stock’s 52-week low was 738, while the 52-week high was 1305.

The estimated market capitalization of the shares is Rs.617,326 crores, which is the highest in the banking sector. With a dividend yield of 0.22 percent, so the stock has been shown to have sufficient credibility to its investors.

Since its inception, it has outperformed the market and increased new benchmark every year.

2. Kotak Mahindra Bank

Uday Kotak, Leadership Kotak Mahindra Bank is one of India’s leading financial services conglomerates, providing a wide span of various financial and banking solutions with a reach of 1600 branches and 2,519 ATMs across India. Kotak Mahindra Bank also emerged as a player who adopted a prudent and cautious approach, targeting only high valuations to customers and sectors. This (net NPA at 0.50%) supported the bank’s low level of bad debt formation over the years.

This banking giant has succeeded to achieve a NIM and profit CAGR of 23% and 24% respectively in 5 years and to grow advances from 29% CAGR in 5 years. Kotak Bank has maintained a cautious approach towards unsecured retail, credit card, and small business lending. 70% of the bank’s advances are given to corporate and business, home loans & amp; LAP and agriculture segment, with the highest-risk corporate and business division of around 40%.

Bank has proven its steady leadership, strong liability franchise, the best class margins and cautious underwriting measures.

Read Also- Top 5 Stock Exchanges In India

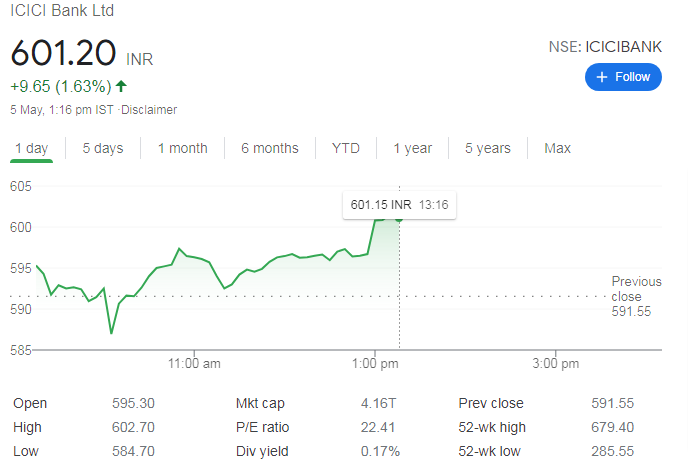

3. ICICI Bank Ltd.

The stake in ICICI Bank is one of the most traded banking shares in India and has a very high volume of 33,199,184. This means that a large number of traders in this country are investing in this stock.

The stock has successfully exited from its 52-week low and has seen a good rise in price per unit. While the 52-week low was 268.30, the 52-week ICICI Bank shares had a high of 522.20.

A dividend of 0.61 is paid to the investors on the basis of their stake. ICICI is a trusted institution for the bank which has partnered with some of the world-renowned partners to offer premium services.

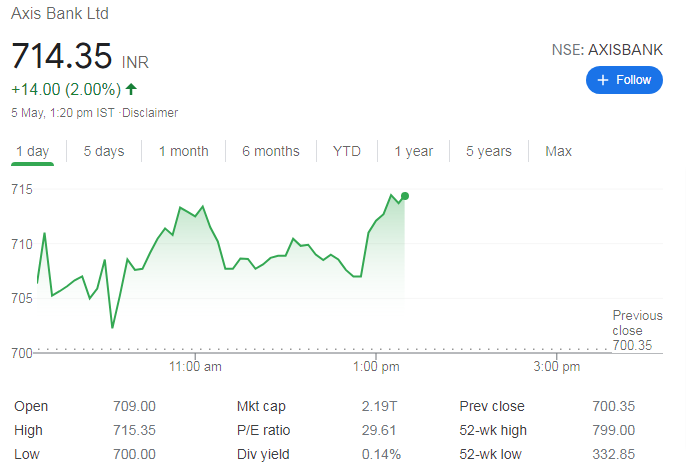

4. Axis Bank

Axis Bank is the third-largest bank in the private sector banking space with a total asset size of Rs.9,07,910 crore as of 31 March 2020, a 14% CAGR over 5 years to the private sector player in FY 2020 Expired ended Recorded healthy capitalization levels and performance for fund growth Demonstrated strong capital capacity and minimum regulatory requirement, as well as a strong capacity for lifting resources through deposits and bonds, Have to maintain more cushion. The total deposits of Axis Bank increased by 16.71% and were Rs. 640,105 crore as of 31 March 2020.

The bank has a sizable Casa deposit base which constitutes around 42.00% of the total deposits as of 31 December, as of 2020 ended 31 December 2020, it has been able to stop the formation of bad loans And a gross NPA reported ratio of 3.44% and a net NPA ratio of 0.74%.

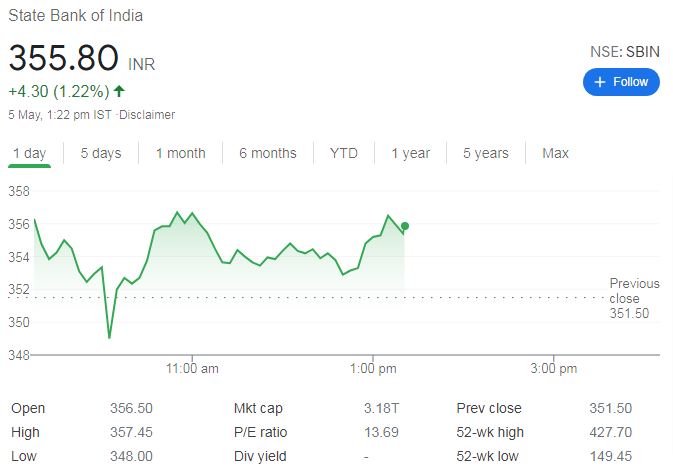

5. State Bank of India

Fourth place in the list of top 10 banking stocks to buy in India is held by State Bank of India.

It is the first government bank and most trusted name in the banking sector to make it to this list. State Bank of India serves one of the largest customer base in India, and its shares help in earning a good deal of return.

The total market capitalization of these shares is Rs. 184282.47 crores and the estimated amount is 54,435,819.

The 52-week low was 149.45, and the 52-week high was 351.