You can find the best credit cards in India 2021 to suit your needs? You are in the right place. If you want cashback, lounge access, free flights, stays free hotel or free business class tickets, you can find everything here.

What is Credit Cards?

A credit card issued to a credit card users (cardholders) enable the cardholder to pay a merchant for goods and services based on the cardholder’s promise to the card issuer to pay for that amount plus other consent fees. have to make. Know about What is a Rewards Credit Cards.

The card provider (usually a bank) creates a revolving account and provides a credit limit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

Top 7 Best credit cards and benifits

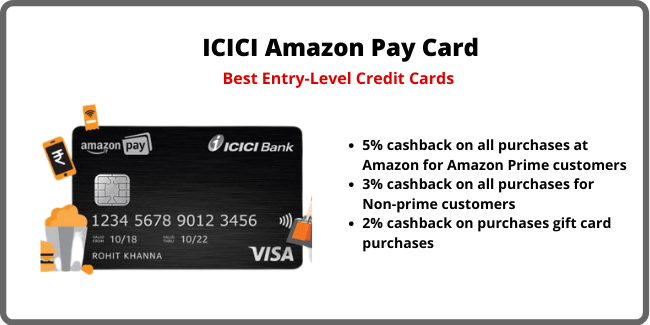

#1. ICICI Amazon Pay Card

If you want to step into a credit card rewards game with no annual fee, this card is for you. The ICICI Amazon Payment Credit Card is known for its amazing integration card with ICICI Bank specifically for one who is already banking with them, to deliver in under 72 hours.

On the one hand this reason, it offers great value for Amazon Prime users and they have other proposals from time to time. Right as valuable in some ways, it is a no-fee card.

| Annual Fee | Reward Rate |

|---|---|

| Nil | 1% – 5% (as Amazon Pay Balance) |

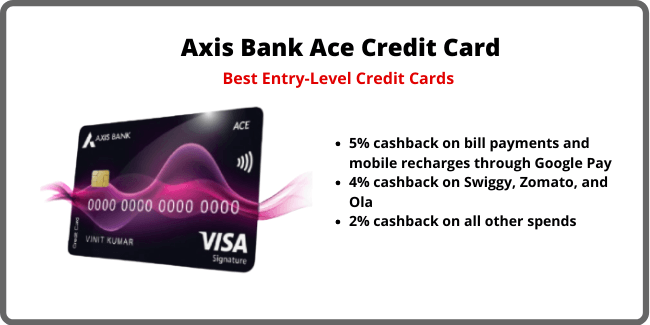

#2. Axis Bank Ace Credit Card

Axis Bank ACE credit card as one of the best cashback credit cards in India, it comes with the highest universal cashback rate of 2%. If you are not sure about the categories where most spend a cashback credit card will be the right choice for you. Here are the top features of Axis Ace Credit Card.

| Annual Fee | Renewal Fee | Minimum Income |

|---|---|---|

| Rs. 499 (Reversed on spending Rs. 10,000 in the first 45 days) | Rs. 499 (Reversed on spending Rs. 2 Lakh or more in the preceding year) | Communicated at the time of sourcing |

#3. SBI Card Prime

SBICard Prime is one of the best credit cards in India to use the lounge with a stone out of the mile after 2017 many cardholders, the bank prime everything you said under the same roof and that 3 million expenditure renewal fee exemption needs too.

Even — although this selection was spent on a quick reward of revoking the character by a slight devaluation in 2019, it is still a very good card for the benefits it comes with.

| Annual Fee | Renewal Fee | Minimum Income |

|---|---|---|

| Rs. 4,999 + GST | Rs. 4,999 + GST | Rs. 60,000 per month |

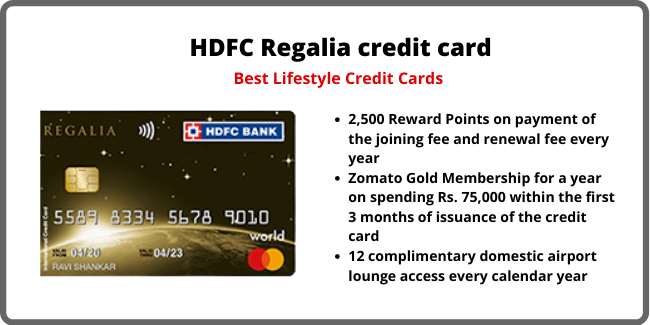

#4. HDFC Regalia credit card

If you are looking for offers for each class for a credit card can, HDFC should openly be your first choice. Is it provides travel offers discounts on food, have a good rewards program and a comprehensive security plan. Let us find out more about HDFC regalia credit card:

| Annual Fee | Renewal Fee | Minimum Income |

|---|---|---|

| Rs. 2,500 + GST | Rs. 2,500 + GST | Rs. 70,000 per month |

#5. Amex Gold Charge

You are in a premium lifestyle, you must have at least one of the Amex card in your pocket. If you need more purchasing power and like it for the Amex Platinum Amex MRCC that serves the purpose but, as we do had seen before, Amex Gold Charge Card understand.

| Annual Fee | Renewal Fee | Reward Rate |

|---|---|---|

| Rs.1000+GST | Rs.1000+GST | 1%-10% |

#6. Indusind Iconia (Amex)

Spend a lot during the weekend? Consider getting a Iconia Amex credit cards. This card has been canceled in unlimited domestic lounge, it is still reward rate, good for Amex’s plan and other cost basis.

This is for credit card enthusiasts and I really wouldn’t suggest for beginners as IndusInd credit card systems are not so great at the moment.

| Annual Fee | Reward Rate |

|---|---|

| Rs.3,500+GST no voucher (or) Rs.10,000+GST with equivalent gift voucher | 1% – 2% |

#7. HSBC credit card

If you are like every now and then to buy a frequent shopper and make-up, you have a shopping credit card that you should give back as cashback. HSBC cashback credit card is one that is a card that offers cash back on all your purchases. Let us have a look at some of the features of the credit card.

| Annual Fee | Renewal Fee | Minimum Income Required |

|---|---|---|

| Nil | Rs. 750 + GST (Waived off on spending Rs. 1 Lakh in the previous year) | Rs. 4,00,000 per annum |

Read Also :- Credit Cards 101:- Define and what is credit carts

FAQs-

In India, credit cards are a lot of come with no annual fee. To name a few, you IndusInd Pioneer Heritage, HSBC Visa Platinum and Citibank credit card rewards.

Most of India’s credit cards safe. HSBC Visa Platinum credit card like cards and City cashback cards are just a few of the secured credit card.

You have a lot of options for the purchase of credit cards in India. Depending on your needs, you can choose SBI SimplySave credit card, City cashback card or HSBC Visa Platinum credit cards, to name a few.

No credit card is a limit offered by various banks which offer several advantages over charges of joining a modest annual. Some of the credit card bank moneyback credit card, ICICI Bank are Platinum credit card, etc.

Using a lot of banks complimentary airport lounge, offer tours credit cards in India with benefits such as airline tickets, additional rewards, air miles and more. Some good travel credit card HDFC regalia credit card, Axis Bank Vistara credit cards, Citi PremierMiles credit card and American Express Platinum Travel Credit Card.